out of

Apple Pro Display XDR Review

By

True Score

True Score is an AI-powered algorithm of product tests and customer reviews.

Mixed Reviews

Experts

Consumers

Expert Rankings

(

)

The Apple Pro XDR Display disappointed reviewers with its limited connectivity options, lack of support for gaming configurations, and inability to calibrate the display. However, they were happy with its color accuracy and brightness.

We’re reader-supported. Commissions finance our mission. Our ‘True Score‘ system independently powers ratings. Learn more

Product Snapshot

Overview

The Apple Pro Display XDR is a high-end 2020 display that pledges to deliver best-in-class color accuracy, deep blacks thanks to Full Array Local Dimming, and excellent peak brightness for both SDR and HDR content. Also, the display’s near-complete coverage of the sRGB, Adobe RGB, and DCI-P3 color gamut makes it a perfect fit for the high-end photo and video production. With the option to get the screen version that is fitted with a nano texture cover glass, users who can’t control the lighting in their environment will benefit significantly from the reduced glare and reflectivity. Those who will need to switch between portrait and landscape mode constantly will also appreciate the flexibility offered by its Pro Stand – options that make the Apple Pro Display a lot more versatile than the Sony BVM-HX310. Make sure you get to the end of this Apple Pro Display XDR review to see how it compares to the top-rated computer monitors available.

Consensus

our Verdict

The Apple Pro Display XDR display is a great choice for content creators and editors, with accurate colors and high brightness levels. Unfortunately, gamers may not be as pleased due to the input lag and lack of G-Sync/FreeSync support. It has a high contrast ratio and beautiful design, but limited connectivity options and no calibration.

Reason to Buy

- Excellent color accuracy and brightness

- Beautiful design

- High contrast ratio

- Sturdy build quality

- Optional nano texture glass cover to reduce glare and reflectivity

Reason to Avoid

- Not ideal for gaming

- No buttons on the monitor for adjustments

- Pro stand purchased separately

- Brightness fall-off at the edges of the screen

Apple Pro Display XDR Specs

| Display Type | Retina 6K Display | |

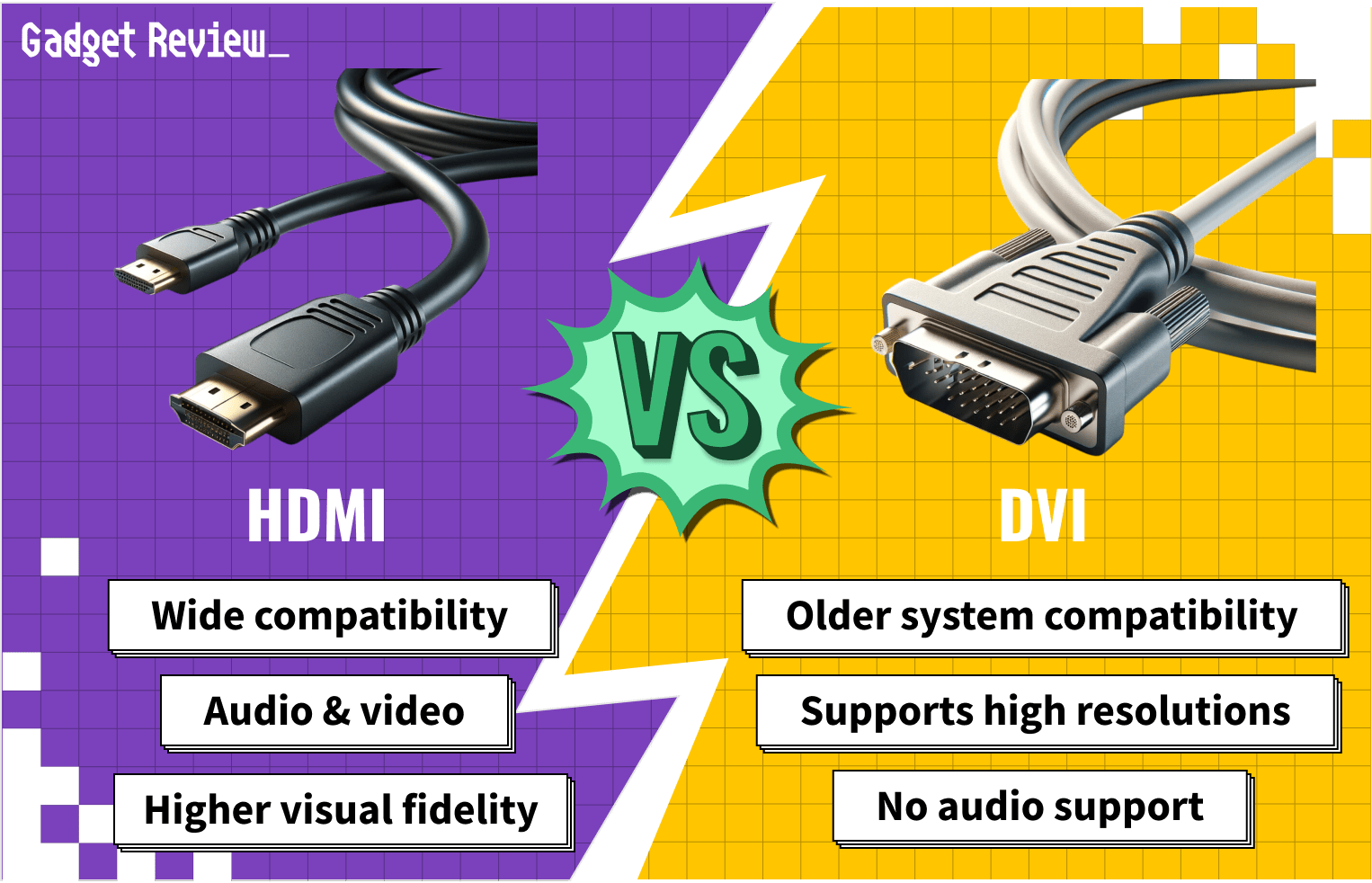

| HDMI Inputs | – | |

| HDR Format | Yes | |

| Max Resolution | 6016 x 3384 | |

| Panel Type | n/a |

| Refresh Rate | 60 Hz | |

| Response Time | n/a |

| Screen size | 32" | |

| Sync Technology | Adaptive Sync |

All Specs

Test Results

We are all about transparency. Click here to view our trusted dataset of product test results.

*0 = no data

| Brightness (nits) | 1,580.45 |

| Contrast Ratio (as ratio, x:1) | 519,518.5 |

| Color Gamut/Accuracy % (DCI P3 xy) | 98.7 |

| Color Gamut/Accuracy % (DCI P3 uv) | 0 |

| Color Gamut % (sRGB Coverage xy) | 94.3 |

| Color Gamut % (Adobe RGB Coverage xy) | 96.7 |

| Color Gamut % (Rec. 2020 Coverage xy) | 0 |

| Color Gamut % (Rec. 709 Coverage xy) | 0 |

| Input Lag (ms) | 0 |

| Response Time (ms) | 0 |

| Horizontal Viewing Angle (Washout Left) | 0 |

| Horizontal Viewing Angle (Washout Right) | 0 |

| Vertical Viewing Angle (Washout Above) | 0 |

| Vertical Viewing Angle (Washout Below) | 0 |

All Tests

Get the Winner of the Day Direct to Your Inbox

All Stores

Updated every 24 hours

- $4,999.00

- $4,999.00

- $4,999.00

Score Card

E

Expert Score

*.75

We place a 75% weighted value on Expert Test Scores

C

Customer Score

*.25

We place a 25% weighted value on Customer Scores

True Score

Any product with a True Score above 80 is a Absolutely Fresh

Expert Score Breakdown

Publications with higher Trust Scores are given more weight.

- 80THE GOODVery brightVery sharpCan do almost anything if set up rightTHE BADExpensiveOff-axis brightness and color… read more

By:

Nilay Patel - 75Apple’s Pro Display XDR provides exceptional color accuracy and build quality at a price that’s… read more

By:

Unknown

Customer Score Breakdown

Learn More About Computer Monitors

Computer Monitor Resource Articles

Computer Monitor Buying Guides

Computer Monitor Reviews

Mixed Reviews

Absolutely Fresh

Absolutely Fresh

Mixed Reviews

Absolutely Fresh

Absolutely Fresh

Absolutely Fresh

Mixed Reviews

Absolutely Fresh

Absolutely Fresh

Mixed Reviews

Absolutely Fresh

Absolutely Fresh

Mixed Reviews

Mixed Reviews

Absolutely Fresh

Mixed Reviews

Absolutely Fresh

Absolutely Fresh