As cell phones and smartphones become more expensive, the rise of cell phone insurance fraud becomes more prevalent even with the best cell phone insurance providers. Fraudsters are finding new ways to get money out of cell phone insurance providers. It’s important to know what kind of penalties there are for committing phone insurance fraud so you can learn the legal manner of filing a claim and avoiding penalties.

Alternatively, if you are a Verizon subscriber and have a damaged screen, you can check out our Verizon phone insurance screen repair guide.

Key Takeaways_

- Cell phone insurance providers are getting better at tracking fraudulent claims.

- Phone insurance fraud can have serious, life-affecting penalties.

- Always tell your phone insurance provider the truth about your claim.

Everything You Need to Know about Cell Phone Insurance Fraud

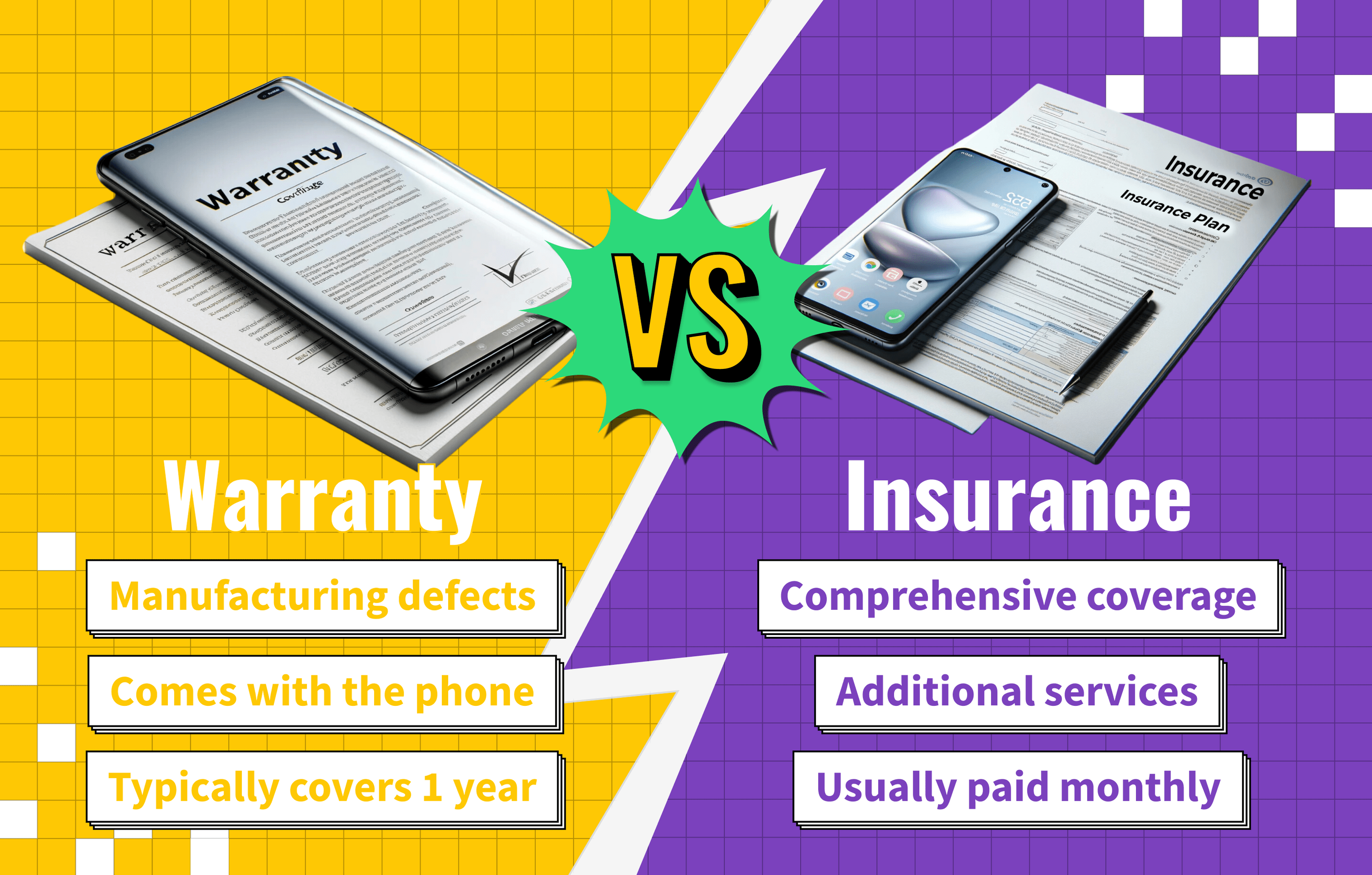

Insurance policies are intended to protect an individual from financial loss in the event that their phone is damaged, lost, stolen, or otherwise rendered inoperable.

Cell phone insurance fraud happens when someone falsely files a phone insurance claim to get the monetary payment or a new replacement phone.

Types of Cell Phone Insurance Fraud

There are many ways that people commit cell phone insurance fraud. Read through the following types of phone insurance fraud to learn more about filing claims the right way.

STAT: Upwards of 40% of all cell phone insurance claims are fraudulent. (source)

False Claim Fraud

When you file a phone insurance claim, it’s important to never lie about timeframes or how the damage occurred. If you lie to the phone insurance provider, you can be convicted of insurance fraud.

False claims are one of the common types of fraud. For example, people damage their phones intentionally and then lie about it to get the insurance payout. Or people lie about when the damage occurred to avoid their policy’s timeframe limitations.

Multiple Policy Fraud

Some people try to take out multiple insurance policies on a single device. Then, they’ll make a claim with each insurance provider to receive multiple payouts.

This method of fraud is very recognizable since many phone insurance providers are owned by the same parent company. For instance, an AT&T insurance claim will be run by Asurion, which is also the phone insurance provider for T-Mobile and Verizon phones.

Filing Claims on Other People’s Policies

Some fraudsters even go as far as to steal other people’s policy information and make false claims about their policies. This allows them to receive the payouts or replacement devices and leaves the real policy owners with the repercussions of never sending in their devices.

Penalties for Committing Cell Phone Insurance Fraud

If you commit cell phone insurance fraud, you can potentially receive some very strict penalties that will stay on your record forever. To ensure you don’t face any fines or charges, read about what to do if you find your lost phone after filing an insurance claim.

Criminal Charges

The criminal charges for committing insurance fraud can vary depending on your home state, but you can expect to receive at least a misdemeanor charge if convicted.

The more money involved in the fraud case, the heavier the charges may be, including up to felony charges.

warning

If you lie to the phone insurance provider, you can be convicted of insurance fraud.

Fines

Most cell phone insurance fraud cases have some kind of fine associated with them.

Again, the amount of these fines can vary from state to state and can increase depending on the amount of money involved in the fraud.