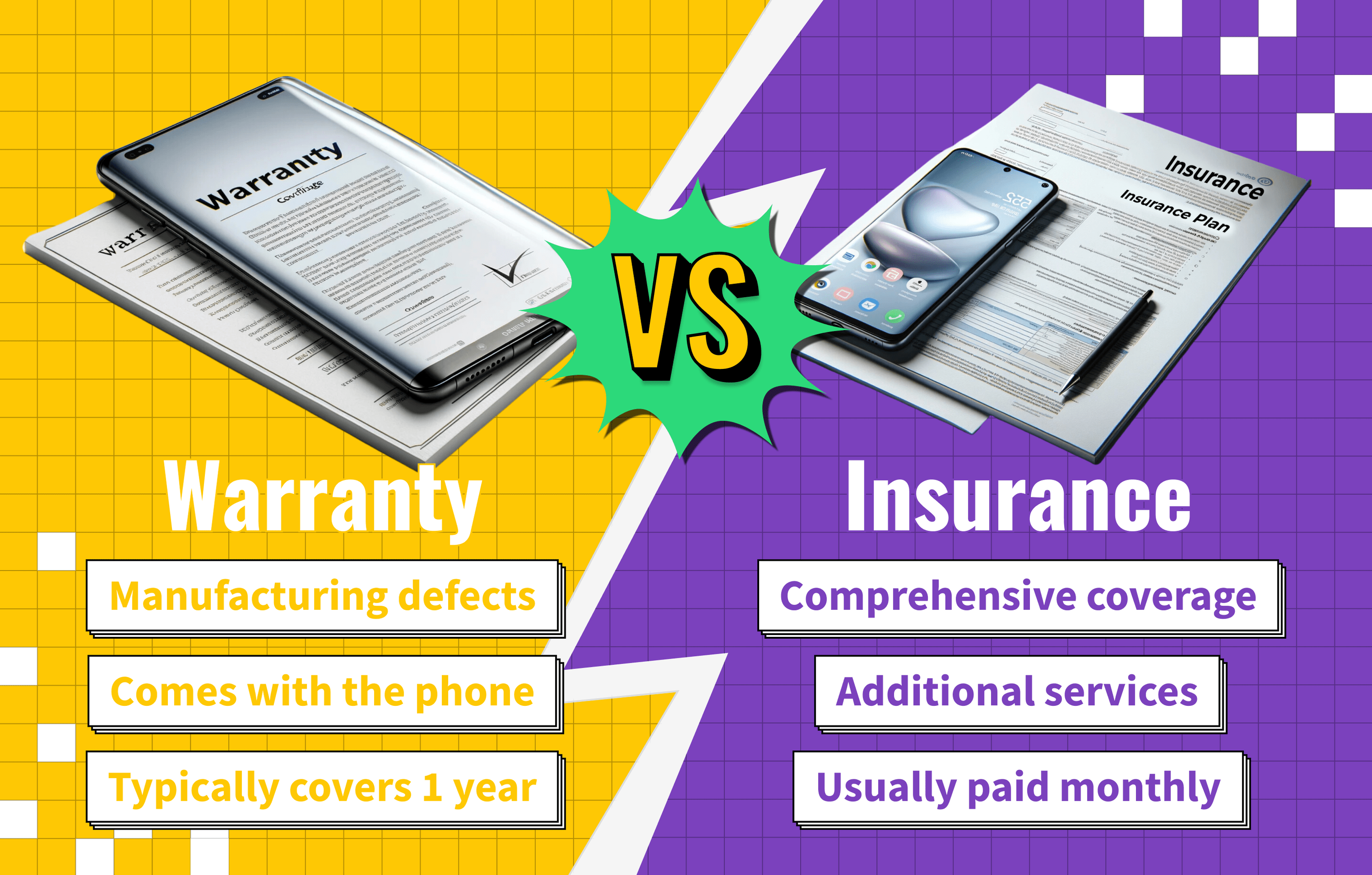

When it comes to protecting your phone, you can stick with your device’s manufacturer’s warranty or purchase a cell phone insurance plan. Each option has its merits, but it is important to understand the differences. In short, a warranty will cover issues that may be the result of a manufacturing defect, while insurance covers a broader range of issues.

Keep reading this article to learn more about the differences between phone warranties and phone insurance so you know which to use for your new smartphone.

Key Takeaways_

- Cell phone warranties are suitable for your smartphone’s base level of protection.

- Cell phone insurance costs more, but it provides much more comprehensive protection.

- Most cell phone insurance providers give you some time to add a plan to your new smartphone so you can do your research in advance.

Learn About What’s Covered Under Phone Warranty and Insurance

A few key differences exist between a smartphone’s warranty and a smartphone insurance policy. While they offer certain protections and replacement options in case you run into trouble with your phone, you’ll want to know the exact details to protect your phone properly.

And if you’re using Sprint, you’ll also want to know about these Sprint screen repair solutions.

Cell Phone Warranty

A cell phone warranty, also known as a manufacturer’s warranty, is essentially a promise from the device’s manufacturer to repair or replace your device under certain circumstances and within a specific timeframe.

Most cell phone warranties are valid for a year from their purchase date. Most computers come with warranties, but great computer repair kits are available if it breaks, as your cell phone might.

insider tip

Most cell phone warranties are valid for a year from their purchase date.

What Does a Warranty Cover?

Your cell phone’s manufacturer’s warranty typically only covers issues that come about due to faulty parts or a manufacturing defect. If your phone suddenly stops working due to no fault of your own, then you’ll want to check with your phone’s manufacturer to see if the problem is covered under warranty.

Remember that a smartphone warranty will not cover accidental damage like screen cracks or water exposure. You may also void your warranty by trying to repair or tinker with your phone yourself. With an insurance plan from Sprint, you’d be better off getting a replacement phone that Asurion remanufactures.

warning

Remember that a smartphone warranty will not cover accidental damage like screen cracks or water exposure.

Purchasing an Extended Warranty

Some smartphone companies will offer extended warranties for their devices. While extended warranties won’t cover more than the standard option, they extend the timeframe during which you can get your phone fixed through the manufacturer.

Most extended warranties add an additional year or two to your standard warranty. Extended warranties are also typically much cheaper than cell phone insurance, so if you’re on a budget, you should reach out to your phone manufacturer to see their available options.

To learn more about warranties, check out this guide to manufacturer warranty vs extended warranty.

insider tip

Most extended warranties add an additional year or two to your standard warranty

Cell Phone Insurance

A cell phone insurance policy covers much more than the manufacturer’s warranty. However, it’s also much more expensive than a warranty. Instead of simply receiving it with your purchase, you’ll need to pay for cell phone insurance.

You’ll pay a monthly fee for as long as you want your insurance coverage to continue. Most cell phone insurance providers allow you to cancel your policy whenever you want without cancellation fees.

STAT: Over 5,600 smartphone screens are cracked every hour. (source)

What Does an Insurance Policy Cover?

Cell phone insurance policies provide the most comprehensive protection and coverage you can purchase for your smartphone. On top of the mechanical and electrical defects that your warranty covers, an insurance policy will also cover accidental damage and situations where your phone is lost or stolen.

It’s important to remember that on top of the monthly fee, you will also pay a deductible whenever you file a claim.

Purchasing a Cell Phone Insurance Policy

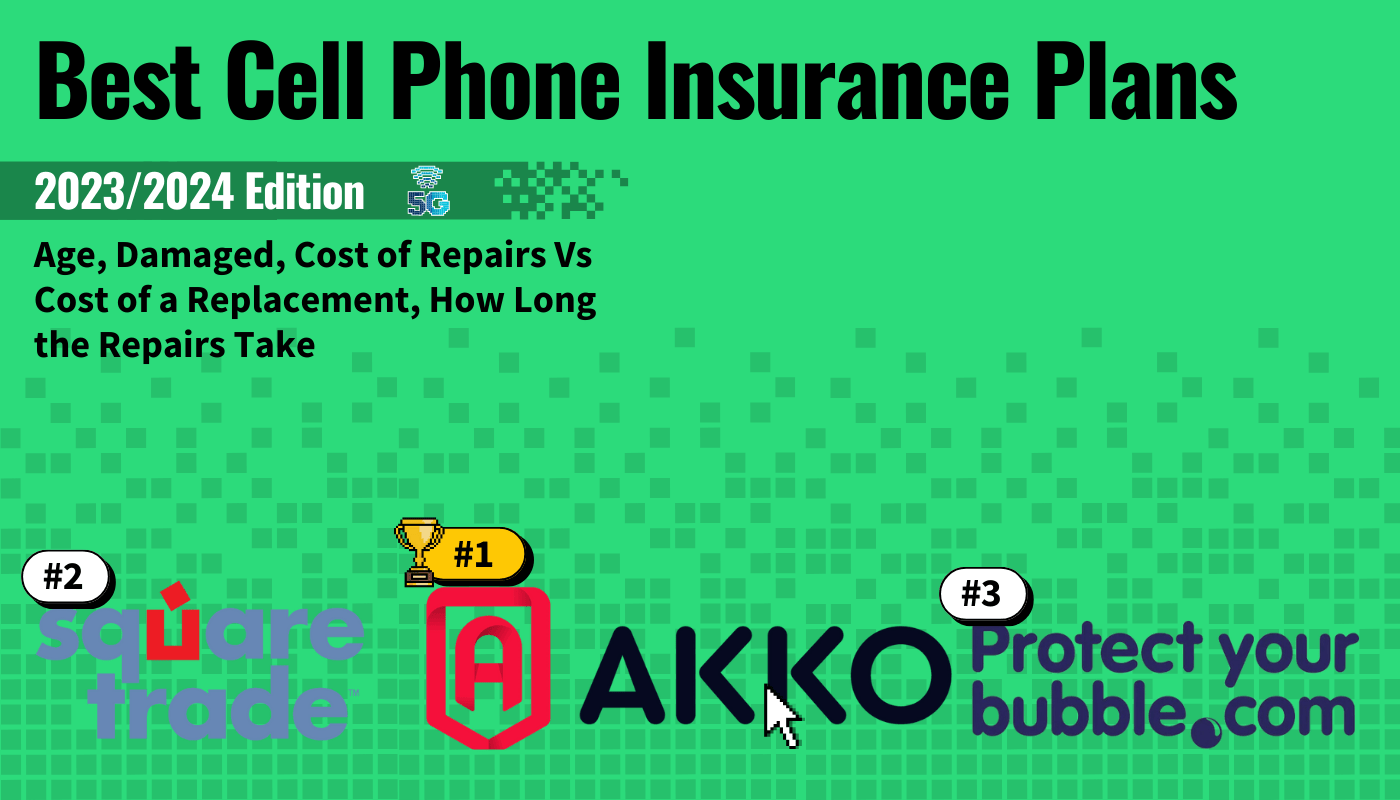

If you want to purchase a cell phone insurance policy, you have a few different options. Virtually all wireless carriers offer their own insurance policies, which you can buy at the same time as purchasing your new smartphone.

However, there are also a variety of third-party insurance providers that are highly rated. It’s perfectly fine to take some time to do your research since most companies will allow you as much as 60 days to purchase a policy.