Our #1 credit card with phone insurance is the Platinum Card from American Express. If use this card to pay your monthly cell phone bill, your smartphone will be covered if it gets stolen or damaged (including a cracked screen). Reimbursement claims to max out at $800 per claim or $1600 per 12-month period. The Platinum Amex card offers not only coverage for your phone but includes excellent travel perks, travel coverage (trip cancelation protection), and access to 100s of airport lounges, which makes it the best travel card with cell phone insurance. Annual fee: $695 Deductible: $50.

What are the features that make for the best credit cards with phone insurance? Before anything else, these cards should give you comprehensive protection for your cell phone. The insurance these cards carry covers a wide range of different problems like damage, theft, and loss. This is a great credit card benefit that many people don’t know about.

Secondly, your credit card cell phone protection plans typically cover all of the devices on your phone plan. This is a huge benefit over traditional insurance policies that require you to pay more for each device you want to be covered.

Finally, personal credit cards with phone insurance should still offer you all the standard credit perks you’re used to. Features like rewards points, airline miles, and cashback are present in many cards in this category.

Keep reading to learn more about the best credit cards with phone insurance so you can make the best choice for your credit card and cell phone protection coverage needs.

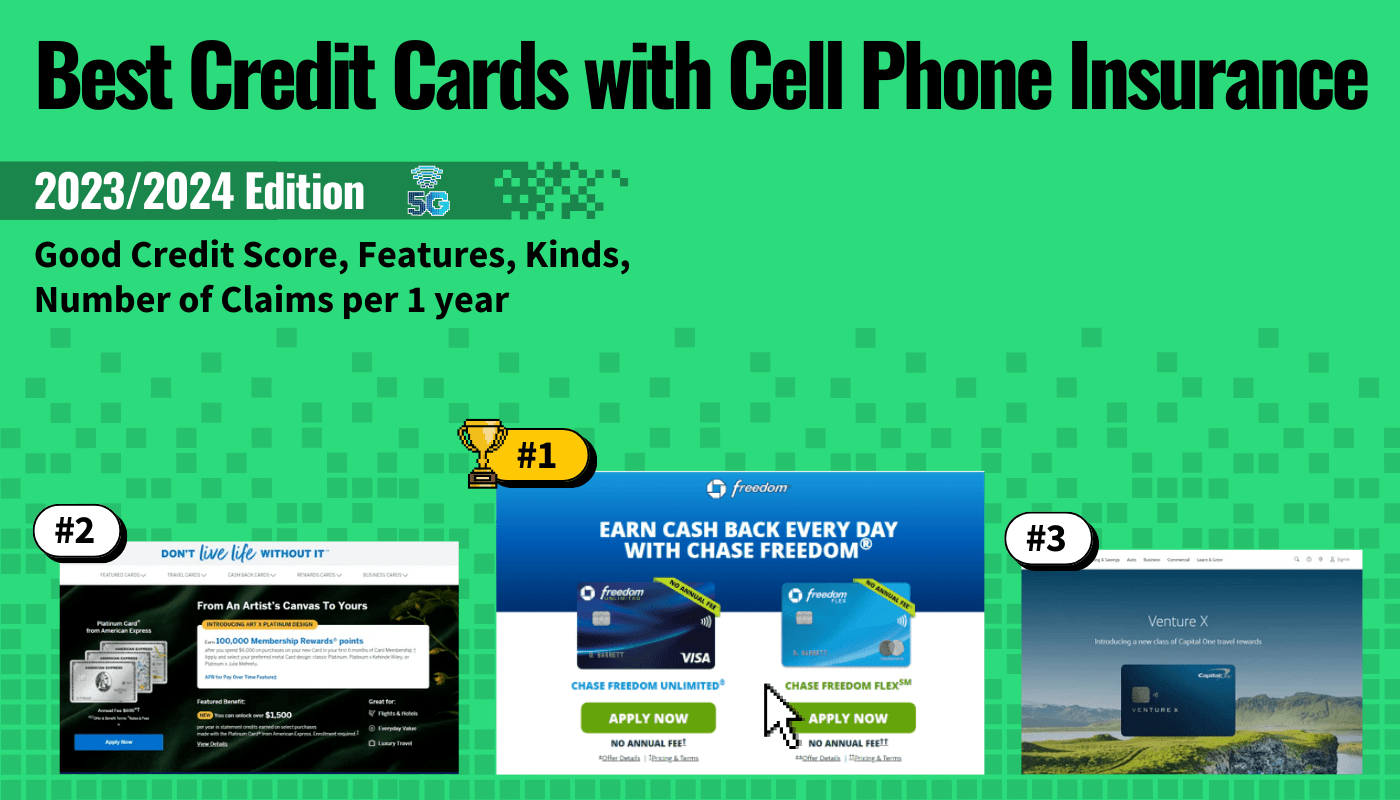

Top Credit Cards with Cell Phone Insurance

#1 Chase Freedom Unlimited Credit Card

Award: TOP PICK

WHY WE LIKE IT: You’ll love that you can earn a $200 bonus with this card. It also has a low intro APR, which means you’ll be saving straight away. Beyond this, you’ll have the ability to earn 5% cash back on qualifying purchases.

- Low intro APR

- Earns 5% cash back

- Opportunity for $200 bonus

- Post-intro APR is high

There is a choice between two different styles for this cad: Unlimited and Flex. Each of them comes with slightly different benefits, putting the decision firmly in your hands. You’ll love the flexibility this option between two cards offers. Unfortunately, once you get past the introductory offer, the APR on either option for this card tends to be on the high side. You’re looking at between 14.99% and 23.74%.

You’ll also have the chance to earn $200 in bonuses. This happens if you spend $500 in the first three months after you open the account, which is extremely easy to do for most consumers. This credit card will offer you 5% cash back on gas station purchases in your first year. This cashback offer works for up to $6,000, making it a fantastic option for those looking to make everyday purchases with their card.

#2 American Express Platinum Credit Card

Award: HONORABLE MENTION

WHY WE LIKE IT: This nifty little card is fantastic for those who travel often. You’ll enjoy access to a $200 hotel credit from participating locations when you use this card to pay. There’s also an opportunity to earn 125,000 membership points.

- Great for traveling

- Earn 125,000 membership reward points

- $200 hotel credit

- Has an annual fee

You’ll have the opportunity to earn 125,000 membership rewards points when you go with this option. That’s far more than competing cards in the same class have to offer. You’ll only have to spend $6,000 on purchases with your new card in the first year to qualify. However, you will have to pay a pretty hefty annual fee to have this card. This comes out to $695 and might be too pricey for some consumers who want to keep a tighter budget.

Beyond that, you can unlock over $1,500 per year in credits on your credit card statement. This will apply to qualifying purchases, but it’s an excellent feature for those looking to use their credit card daily. This credit card is a fantastic option for those looking to book flights or stay in hotels. While it has excellent everyday value, you’ll also love the benefits it has for luxury travel. You’ll also have protection on your cell phone for up to $800 for major repairs or total loss. This covers two claims that are approved over 12 months.

#3 Capitol One Venture X Credit Card

Award: BEST FOR TRAVELING

WHY WE LIKE IT: If you’re somebody who is constantly on the go, this credit card will be a perfect pick for your wallet. It has a $300 annual travel bonus when you book using the card. It also provides a $100 TSA PreCheck credit.

- Early spend bonus

- $300 annual travel bonus

- $100 TSA PreCheck credit

- High credit required to qualify

Those looking to travel often will find that this credit card fits their every need. You’ll be able to unlock $300 in annual travel credit if you book through the brand’s travel service. If your phone is lost or stolen, you’re also protected. This card will reimburse you up to $800 toward your phone. Unfortunately, you will need to have stellar credit to qualify for this credit card. The company specifies that your rating must be “Excellent,” or you will not be able to get it.

You’ll also get $100 in Global Entry or TSA PreCheck credit. This means that you won’t have to wait in long lines at the airport, and you can guarantee that you’ll never be late for a flight again due to the lengthy check-in process. When you spend $4,000 in the first three months with this card, you unlock 75,000 Early Spend bonus miles. This is an excellent reason for those who are often traveling to choose from options.

#4 U.S. Bank Visa Platinum Credit Card

Award: BEST FOR INTRO APR

WHY WE LIKE IT: You won’t have to pay any pesky annual fees to have this card, which is a huge plus for anybody trying to tighten up their budget. It also has a 0% introductory APR and a convenient mobile wallet experience.

- 0% introductory APR

- Doesn’t include an annual fee

- Convenient mobile wallet experience

- Customer support is lacking

The low APR on this card makes it an excellent option to ensure that costs stay low. This makes it a perfect budget option for those who don’t want to spend too much on their credit card interest. You’ll also earn cell phone protection if you pay your cell phone bill with this card. This will include $600 worth of coverage for damage or theft. However, you’ll want to keep in mind that consumers have reported not-so-great experiences with customer service. This is primarily due to the limited hours that they are reachable.

You’ll also enjoy that there’s no variable fee on this card. Another fantastic feature that keeps this a budget-friendly option for credit cards. They offer a decision on this card in as little as sixty seconds. That means you won’t have to worry about a long wait time before you get your decision. Beyond this, you’ll love the ability to add this card to your mobile wallet easily. That means you’ll be able to use it even if you forget your wallet at home.

#5 Navy Federal nRewards Credit Card

Award: BEST FOR BUILDING CREDIT

WHY WE LIKE IT: This card is fantastic for those looking to establish their credit. However, it’s also an excellent choice for those who need to rebuild their credit. You’ll enjoy 1x rewards points per dollar that you spend.

- Great for establishing credit

- 1x points earned per dollar spent

- Will help rebuild your credit

- Not meant for established credit

Those looking to build their credit for any reason will love using this card. It’s made for that reason specifically. Because of this, approval odds for it are great, and most consumers will be able to apply depending on their personal history successfully. You should remember that this is a card meant for those either establishing or rebuilding their credit. Because of this, it will lack many features that more advanced cards come with.

You’ll enjoy the fact that you won’t have to pay any annual fees to have this card. There are also no balance transfer fees, so you’ll be able to save money there, too. This is a terrific pick for your wallet if you’re somebody who often travels outside of the country. It doesn’t charge international transaction fees, so you can travel abroad without worrying. Finally, you’ll also love that it doesn’t include cash advance fees.

#6 Deserve Digital First Credit Card

Award: BEST FOR CRYPTOCURRENCY

WHY WE LIKE IT: You’ll be able to easily add this card to Apple Pay for more convenient transactions on the go. This card will also provide up to 1.5% rewards and doesn’t charge foreign transaction fees.

- Easy-add to Apple Pay

- Rewards up to 1.5%

- No foreign transaction fees

- No physical card available

You can get approved for this card without taking a hit to your credit. This is excellent news for anybody worried about their credit lowering due to an inquiry. You can get started quickly and easily using Apple, Google, or a different email address. Unfortunately, there is no physical card offered by this company yet. Because of this, you won’t be able to rely on the backup of having a physical card if your phone dies.

You’ll benefit from cell phone protection when you pay your bill using this card. This protection will give you coverage of up to $600 if your phone is lost or stolen. This is an exceptionally easy card to use since you can instantly add it to Apple Pay. The ability to use your card in a digital wallet means you can stop bringing a bulky wallet with you wherever you go and still have access to your funds. You’ll love that they don’t charge an annual fee, so the costs associated with using this card are low. This credit card will also offer you Mastercard World Benefits.

Beginner’s Guide to Credit Cards with Phone Insurance

What Are Credit Cards with Phone Insurance?

Consumer credit cards with cell phone insurance are just what you might expect them to be, based on their name. Essentially, these credit cards extend the standard line of credit from a bank that you can use to make eligible purchases. Then, you are required to pay that money back to the bank, usually with interest added.

Cell phone insurance credit cards offer an additional perk, though. They provide you insurance for the smartphone on your cell phone plan at no charge to you, including additional lines. Keep in mind, this is insurance vs warranty are very different. Insurance will cover specific damages done to your phone, while a warranty will repair/replace your phone based on how long the coverage lasts.

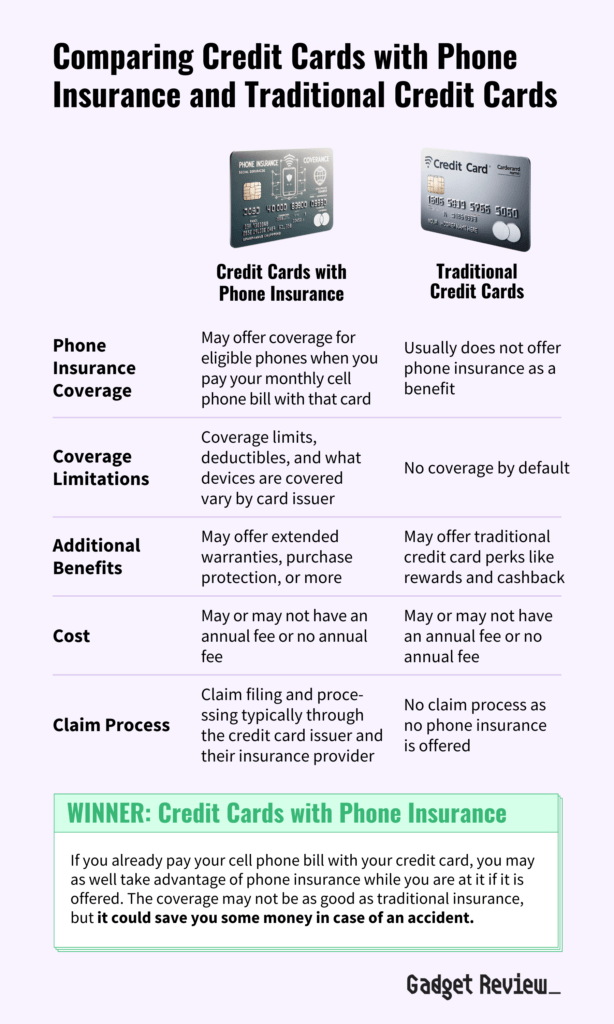

Credit Cards with Phone Insurance vs Traditional Credit Cards

When you consider their core functionality, the top credit cards with phone insurance don’t differ much at all from traditional credit cards. You’re just insuring your property while having credit. You’ll get a line of credit extended to you based on your credit score and credit history, which you can then use to make eligible purchases anywhere your credit card provider is accepted.

The main difference lies in the types of perks you get by being a cardholder with that specific bank. The nice perks on traditional credit cards include things like points and cash back, while the cards in this category give you free cell phone insurance.

How Credit Cards with Phone Insurance Work

You might be wondering how a credit card provider can give you insurance for your cell phones. Fortunately, there isn’t anything that prevents credit card issuers from providing insurance for smartphones. Let’s take a closer look at how this all works:

- How do you get coverage? If your credit card includes cell phone insurance, then all you need to do is pay your monthly cell phone bill with that credit card. The insurance will automatically be included.

- How many phones are covered? For the most part, your insurance will cover all of the devices on the bill you pay with your credit card. However, each credit card has different terms and conditions, so you’ll want to be sure you understand coverage limits before trying to make a claim.

- What problems are covered? Most credit card cell phone insurance will cover the most common problems you may encounter with your phone, including accidental damage, water damage, and theft. When it comes to loss and cosmetic damage, though, you may find varying coverage limits. We recommend checking with your credit card provider to see if loss or cosmetic damage is covered.

- How much do you need to pay? Unlike traditional cell phone insurance, you won’t be required to pay anything upfront to get insurance if you have a credit card that offers insurance. Instead, you’ll only be responsible for paying the deductible when you make a claim, which usually ranges anywhere from $25 to $100.

Do You Really Need a Credit Card with Phone Insurance?

If you don’t have insurance through your cell phone provider and you don’t want to get insurance through them, then using a credit card with phone insurance is an excellent option. However, these types of credit cards are still great for people who do have insurance through their cell phone company.

Is a Credit Card Card with Phone Insurance Worth Getting?

- You Want Extra Protection for Your Phone: Purchasing a brand new cell phone can get expensive really fast, especially if you get a flagship smartphone. If you’re looking for more protection than the manufacturer’s warranty, then using a credit card with phone insurance can give you the extra protection you’re looking for.

- You Like Credit Cards with Perks: The smartest people use credit cards for the perks, not necessarily for the line of credit. If you like using credit cards that offer more than the standard perks, then this option is the best choice for you.

- You Break or Lose Your Phone a Lot: Whether you’re clumsy or just have bad luck, it can get incredibly frustrating and expensive to constantly break or lose your phone. If this is you, a credit card with phone insurance can go a long way in helping you save money and stay protected.

Why a Credit Card with Phone Insurance May Not Be For You

- You Don’t Have Good Credit: In general, there isn’t a good reason to avoid using a credit card with cell phone insurance, especially since the perk is free. However, if you have bad credit, then getting a new credit card just for phone insurance generally isn’t worth it. With bad credit, you’ll have a higher interest rate, which means more money spent in the long term.

- You Can’t Pay Your Bill On Time Each Month: In order to get the phone insurance perk, you have to pay your phone bill with the credit card that offers the perk. If you can’t pay your credit card bill on time each month, we don’t recommend applying for one of these cards.

How Long Will a Credit Card with Phone Insurance Last?

The best credit cards with phone insurance can last for as long as you like. This is contingent on the credit card you have. You are required to keep your credit card open as long as you have a running balance, but once that’s paid off, you can technically close it whenever you want.

However, the length of time you keep your credit card open can depend on a wide variety of factors. Industry experts at NerdWallet recommend keeping your card open indefinitely if you can. When you close a card, your credit score can take a negative hit.

Ultimately, there is no downside to keeping your credit card with phone insurance open forever. As long as you’re using it, benefitting from the perks, and paying it off on time every month, then a credit card with phone insurance is a helpful tool for building credit and protecting your expensive smartphone.

How to Choose the Best Credit Card with Phone Insurance

Choosing a new card can be a complicated and drawn-out process, especially if you don’t know what you need to look for. As such, finding a new card with phone insurance can be even more difficult, considering the fact that you also need to consider what kind of insurance will be best for your needs.

Continue reading this section to learn more about the specific considerations to make when looking for the top credit card with cell phone insurance.

Credit Card with Phone Insurance Key Factors to Consider

One of the best ways to find the best credit card with phone insurance to fit your financial and smartphone protection needs is to determine those needs ahead of time. Then, you can choose an option that fits those needs.

Ask yourself the following questions to determine your needs and aid you in your search for the best credit card:

1. How good is your credit score?

Before you dive into specific card terms and interest rates and before you even start to consider perks like cell phone insurance, you’ll need to know what your credit score is. Your score will determine what kind of card you get and what kind of interest rates you’ll have.

- Poor and Fair Credit: If your score is 669 and below, then you are considered in the Poor or Fair Credit bracket. In general, cards in this category are meant to help you repair or build your credit. As such, it’s unlikely that you’ll get a card with perks like cell phone insurance.

- Good Credit: If your score is in the 670 to 739 range, then you are considered to have good credit. In this category, you should be able to qualify for most cards, including those with perks like cell phone insurance.

- Very Good Credit: If your score is 740+, then you won’t have any problem qualifying for a credit card with cell phone insurance. In fact, you should be able to qualify for a premium card or business credit card that offers additional perks like airline miles, cash back, and reward points.

2. Are all of the core credit card features right for you?

Once you know the state of your credit and the type of card you’ll be able to qualify for, you’ll want to make sure the credit card offers all of the right terms and features for your financial situation. The perk will always be secondary to that.

Consider things like APR, annual fees, and balance transfer fees. These terms can be confusing at times, so make sure you understand them before signing your name.

3. What kind of deductible do you want to pay?

Once you find a credit card that fits your credit score and general usage habits, it’s time to start looking at the specifics of cell phone insurance. Most credit card companies will require you to pay a deductible per claim, anywhere from $25 to $100.

Consider what you’d feel comfortable paying for a deductible when you need to repair your phone and choose the credit card that fits.

4. How many claims do you think you’ll need per 12-month period?

Credit card companies also typically limit the number of claims you can make during a 12-month period. For the most part, this maxes out at two claims per 12-month period. If you expect to need more than two claims in a 12-month period, you may want to supplement your credit card phone insurance with a different provider. You may also want to look into month-to-month insurance; that way, you don’t need to pay for a full year if you never use it.

5. What kind of other credit card perks do you want?

There’s no rule stating that you can only have one perk per credit card. Many of the best credit cards with phone insurance offer additional perks like purchase protection. Take some time to consider what additional perks you like and choose a card that offers those, as well.