warning

It should be noted that Sprint merged with T-Mobile, and the Sprint brand was discontinued on August 2, 2020.

If you had a smartphone when T-Mobile and Sprint merged, you might be wondering if T-Mobile’s Protection<360> service is a good deal. Like most phone insurance, it will cover your phone for accidental damage and theft or loss, but is it worth the price? Keep reading as we look at what is offered.

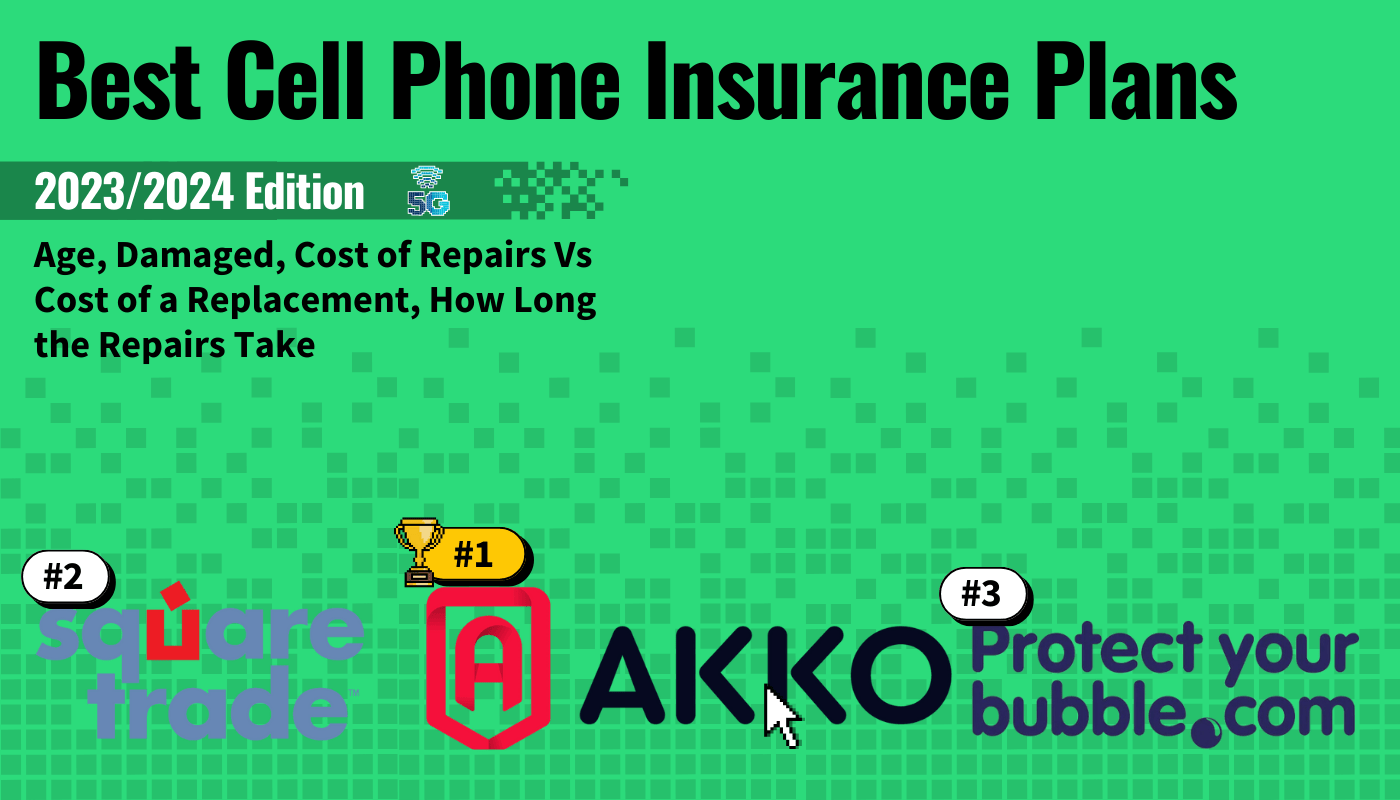

Alternatively, you can check out some of the top-tier cell phone insurance providers.

Is Protection<360> Worth It?

This depends on the consumer, their smartphone, and what type of coverage they are looking for. In the same way, you would ask for any phone policy cover, is phone insurance worth it?

That’s not much different than wondering if Asurion is worth it, since specific phone insurance plans will differ. Generally speaking, like most phone provider insurance plans, it is a mixed bag.

Although, you might like Geek Squad Protection or Metro Phone Insurance instead.

Phone Insurance Coverage Cost

The monthly premium for Protection<360> plans ranges from $7 to $25 (+ any applicable taxes), depending on what kind of smartphone you own. Each smartphone falls into a tier that impacts this monthly premium.

Other providers, such as SquareTrade, offer a 30-day trial, but many would ask, is SquareTrade worth it despite its five-star rating from most reviews?

What Do Sprint Insurance Plans Cover?

It is important to understand the exact scenarios in which Sprint’s Total Equipment Protection plan will offer coverage.

Phone Malfunctions

If your phone malfunctions out of the blue, it is likely that a Protection<360> insurance plan will cover it. This will pertain to damage pertaining to a manufacturing error or just everyday wear and tear.

It is important to note that Protection<360> insurance plans will not cover any malfunction that is caused by customer negligence or any damage that was purposefully caused by a consumer.

Accidental Damage

Protection<360> insurance plans will cover many instances of accidental damage to a smartphone, tablet, or related device. This includes water damage, which could happen accidentally via a phone dropping into a pool or a toilet.

This also includes cracked screens and broken displays, both of which can occur when a phone is accidentally dropped onto a hard surface, such as concrete or pavement.

Additionally, if you buy a screen protector from T-Mobile, they will replace the screen protector at no extra cost if it becomes damaged.

Theft and Loss

One of the key benefits of purchasing a Protection<360> plan is to ensure a replacement device can be issued to you in the event of a loss or theft. A phone replacement is not free with these plans; however, the price will depend on the device that needs to be replaced.

An insurance plan will only likely cover one instance of theft or loss in a given period.

Extra Offerings

While Protection<360> does have an app that you can use for filing your claim, like most providers, they also offer some features that others don’t. You can get security provided by McAfee to protect your identity, privacy, and against digital threats.

Additionally, they offer an upgrade program called JUMP! With JUMP!, if you have paid off at least 50% of your device’s cost, you can upgrade to a new device without paying off the remainder of the old device.

This is a great option if you like to always have the newest version of a phone.