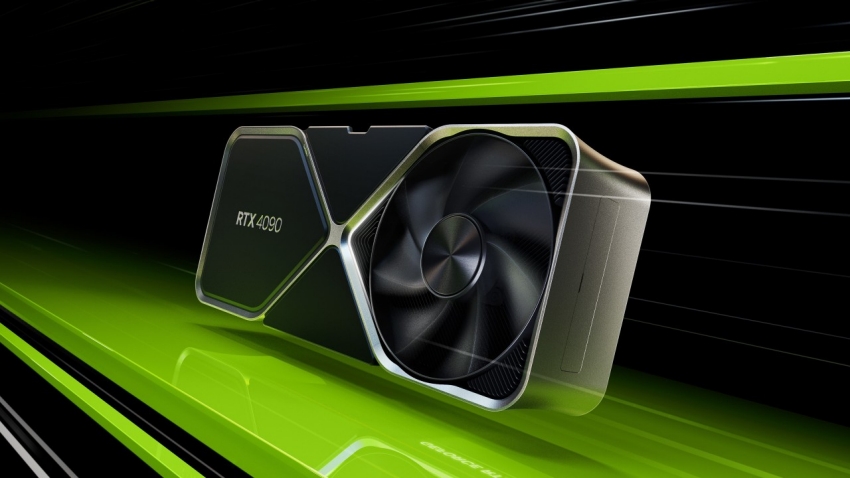

Nvidia just grabbed 94% of the discrete graphics card market, and your wallet is about to feel it. The company’s stranglehold tightened another two percentage points in Q2 2025 as shipments surged 27% quarter-over-quarter to 11.6 million units, according to Jon Peddie Research. This isn’t normal seasonal demand—it’s panic buying ahead of tariff-driven price hikes that have retailers scrambling and gamers making desperate upgrade decisions.

AMD Fades While Intel Disappears

Competition has essentially evaporated as Nvidia approaches monopoly territory.

AMD’s market share dropped to just 6%, while Intel’s discrete GPU presence rounds to zero. The numbers tell a brutal story: shipments hit 5.7% above the 10-year seasonal average, with Q2 retail shortages that JPR calls “highly unusual.” If you’re shopping for graphics cards, your choices have never been more limited.

Nvidia’s pricing power now extends across virtually every performance tier. Desktop CPU shipments also increased 21.6% quarter-over-quarter, with AMD’s CPU shipments surging 27% while Intel’s rose only 2%. The GPU attach rate hit 154% this quarter, driven by enthusiasts running multiple cards.

Tariff Terror Drives Pricing Chaos

Graphics card prices reflect market uncertainty as buyers rush to beat anticipated increases.

Midrange and entry-level cards saw price drops, but high-end models climbed higher. “We think it is a continuation of higher prices expected due to the tariffs and buyers trying to get ahead of that,” explains Dr. Jon Peddie.

Supply chain planning has become nearly impossible, creating the inventory chaos driving current shortages. Your upgrade timeline just became a chess match against international trade policy. Market uncertainty surrounding tariffs continues to disrupt planning for PC suppliers, resulting in unusual inventory cycles and computer problems.

The Boom Won’t Last

Market analysts predict a significant contraction following the current artificial surge.

JPR forecasts a compound annual growth rate of -5.4% through 2028, with current volumes deemed unsustainable. The firm projects an installed base of 163 million discrete GPUs by 2028. While Nvidia might introduce RTX 5000 Super variants by late 2025, AMD’s next major architecture won’t arrive until 2026 or 2027.

Steam’s hardware survey confirms consumer preference alignment—seven of the top thirteen GPUs are Nvidia’s latest Blackwell cards. Data center GPU shipments also rose 4.7% quarter-over-quarter, complementing the desktop trend. Your purchasing window is closing faster than expected.

Market uncertainty makes planning impossible for suppliers and buyers alike. If you need an upgrade, the current chaos might be your last chance before a multi-year market contraction begins.