Dead crypto features shouldn’t plague your favorite trading app, yet Robinhood‘s latest expansion eliminates those gaps entirely. The company just unleashed ETH and SOL staking for U.S. users, perpetual futures with 7x leverage in Europe, over 1,000 tokenized stocks, and—plot twist—their own Ethereum Layer-2 blockchain called “Robinhood Chain.”

This isn’t your typical feature update. Robinhood handled $232 billion in crypto trading volume over the past year while holding $51 billion in customer assets under custody, proving crypto drives serious business. Now they’re weaponizing that scale against Coinbase and Binance with tools that were embarrassingly absent from their platform.

Staking Finally Arrives Stateside

ETH and SOL rewards start in New York, expanding nationwide as regulators approve.

Your idle crypto can finally earn yield without leaving Robinhood’s familiar interface. ETH and SOL staking launches first in New York—because navigating 50 different state regulations is basically playing regulatory Wordle on expert mode. The rollout includes enhanced trading APIs for high-volume traders and cost-basis tools that’ll save you hours during tax season. Robinhood takes their platform cut from staking rewards, but the convenience factor might justify the fee for users who value simplicity over DeFi’s DIY approach.

Europe Gets the Advanced Trading Treatment

Perpetual futures expand beyond Bitcoin with up to 7x leverage on meme coins and major alts.

European users can now trade perpetual futures on XRP, Dogecoin, and SUI with leverage that would make traditional brokers nervous. The 7x maximum leverage defaults to the lowest setting—you have to manually opt into the danger zone, which is probably wise given how quickly leveraged positions can liquidate your portfolio. Meanwhile, over 1,000 tokenized U.S. stocks and money market funds from partners like J.P. Morgan offer 24/7 trading access to American equities, turning European nights into Wall Street trading sessions.

The Blockchain Power Play

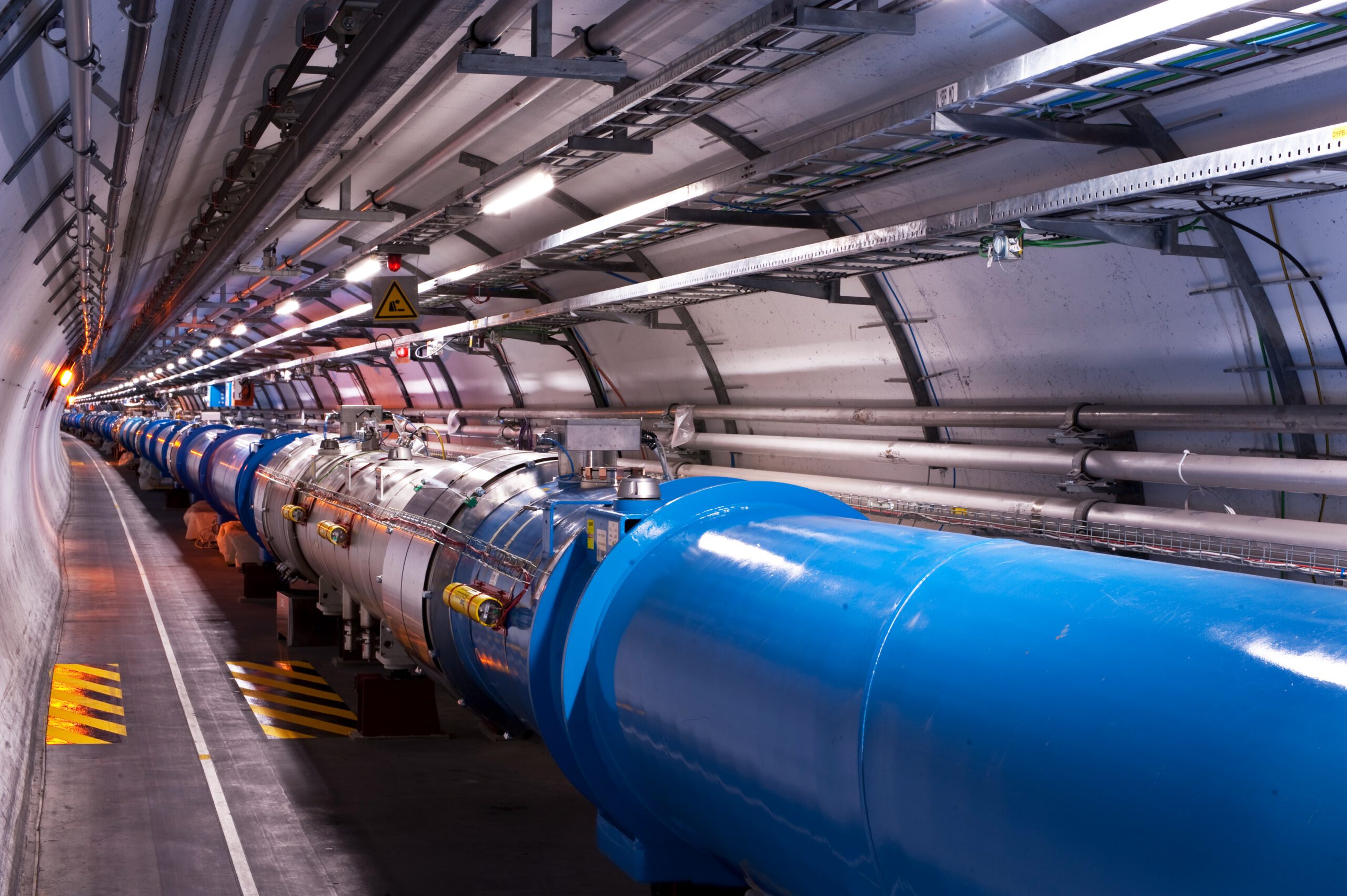

“Robinhood Chain” aims to break traditional brokerage limitations with tokenized everything.

Here’s where things get interesting. Robinhood Chain represents their biggest bet yet—an Ethereum Layer-2 designed to host tokenized stocks and eliminate what crypto GM Johann Kerbrat calls the traditional brokerage “walled garden.” The EVM-compatible chain promises self-custody options and bridging capabilities, potentially letting you trade tokenized Apple shares in DeFi protocols. That’s either revolutionary or completely insane, depending on how regulators react.

Your crypto investment options just expanded dramatically. While Robinhood plays catch-up to established exchanges, they’re betting that mainstream UX will win over crypto’s notoriously complex user experience. Whether tokenized stocks on a proprietary blockchain succeeds remains to be seen, but your trading app certainly isn’t boring anymore.