In a week defined by one of the most violent market liquidations in crypto history, Binance’s BNB token charted its own course. Investors faced a historic $19 billion liquidation event that sent the broader market tumbling. Yet, BNB surged. It hit a record high of $1,370 following a 28% weekly rally. For a short time, this valuation moved it ahead of XRP into the number three spot globally. This decoupling from the wider market crash highlights BNB’s resilience as a major financial asset.

Even as the market chaos allowed USDT to reclaim the third position, BNB has since settled comfortably in fourth place. With a market capitalization of approximately $178 billion, it holds a commanding lead over XRP’s roughly $155 billion valuation and remains well ahead of other large-cap projects)

The recent news of Binance co-founder Changpeng Zhao (CZ) being pardoned by President Trump shows that the US is committed to removing regulatory uncertainty from the market. BNB price jumped 6% as the news came out. In a statement on X, CZ posted, “Deeply grateful for today’s pardon and to President Trump for upholding America’s commitment to fairness, innovation, and justice. Will do everything we can to help make America the Capital of Crypto and advance web3 worldwide.”

BNB Briefly Claims the Third Spot

BNB’s rise was nothing short of explosive. BNB added over $40 billion to its market capitalization within a single week. This aggressive buying drove the price to a record $1,370. The speed and volume of the move points to substantial investor confidence in the asset. What made it remarkable was the timing. This all happened as extreme fear gripped every other corner of the digital asset market.

Geopolitical tensions initiated the market slide, specifically President Trump’s tariff threats regarding China. This news caused immediate panic, resulting in crypto’s largest single-day liquidation event on record. Leveraged positions worth $19 billion were wiped out. The market-wide deleveraging pushed BNB back to the fourth spot as capital fled to the perceived safety of USDT.

The crucial story, however, was BNB’s resilience amid the wreckage. Many altcoins were decimated, losing half their value or more. But BNB’s drop was far more contained—just 9.6%. It held firm above the $1,100 support level, a clear sign of deep liquidity and real market strength. Amid widespread selling, capital rotated into BNB. Investors treated the asset as a safe haven, a role historically occupied almost exclusively by Bitcoin during market stress.

What Is Behind BNB’s Recent Jump?

BNB’s ability to outperform the market stems from a potent mix of deep-rooted fundamentals and powerful new catalysts that differentiate it from purely speculative assets. A key pillar of BNB’s recent strength is the increasing flow of institutional capital, reflecting a calculated strategy by large entities to gain exposure. As Binance CEO Richard Teng commented in a recent interview with Fortune Magazine, “Wall Street’s growing embrace of crypto now extends far beyond the spot exchange-traded funds (ETFs) that dominated headlines in 2024.” Teng continued, “The creation of composite products and new models based on traditional instruments is accelerating, with BTC—and soon, other digital assets—becoming a cornerstone of modern financial infrastructure in many direct and indirect ways.”

The most significant recent development arrived in the form of state-level adoption. Kazakhstan is already a major player in crypto mining—and it is building a formal regulatory system for digital assets. Now, it’s taking another step by launching the state-backed Alem Crypto Fund to manage its long-term reserves. Significantly, the fund’s first move was to invest in BNB. This action, coming from a sovereign entity, cements Kazakhstan’s position as a strategic participant in the global crypto industry.

This new catalyst is built on the foundation of BNB’s extensive ecosystem utility. The token is integral to Binance’s crypto ecosystem, used for trading fee discounts, participating in Binance Launchpad token sales, serving as the gas token for the BNB Chain, among other use cases. This utility drives real, consistent demand that isn’t just about speculation.

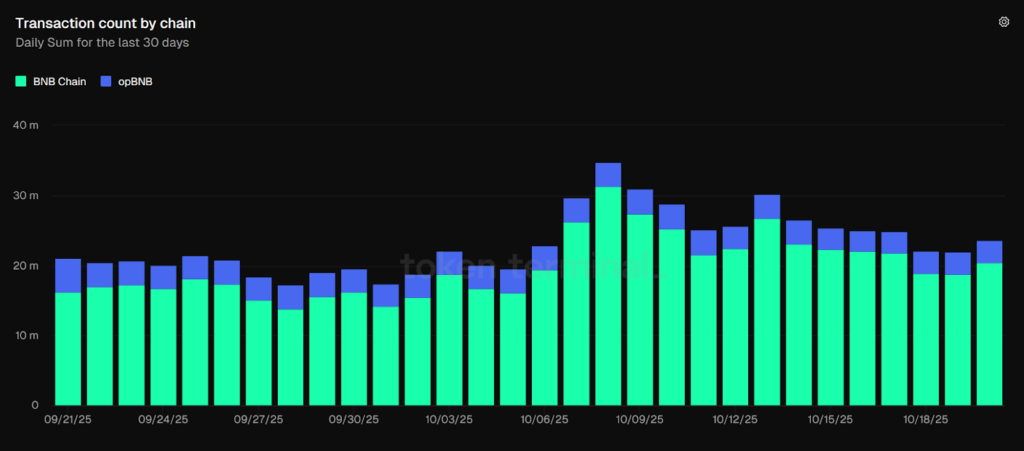

You can see the network’s utility in its daily transaction count, which consistently neared 30 million during the rally. This volume clearly goes beyond speculation. It’s driven by a vibrant mix of DeFi, GameFi, and other dApps that keep the chain active no matter the market’s direction.

And the chain isn’t standing still. Technical improvements, including the Maxwell upgrade in June, are constantly boosting performance and scalability, making it increasingly attractive for both builders and the people using their dApps.

Further support comes from its deflationary tokenomics. Through a quarterly Auto-Burn mechanism, Binance has permanently removed over 50 million BNB from circulation. This systematic supply reduction creates deflationary pressure that supports the token’s long-term value proposition and signals a commitment to value accrual for holders.

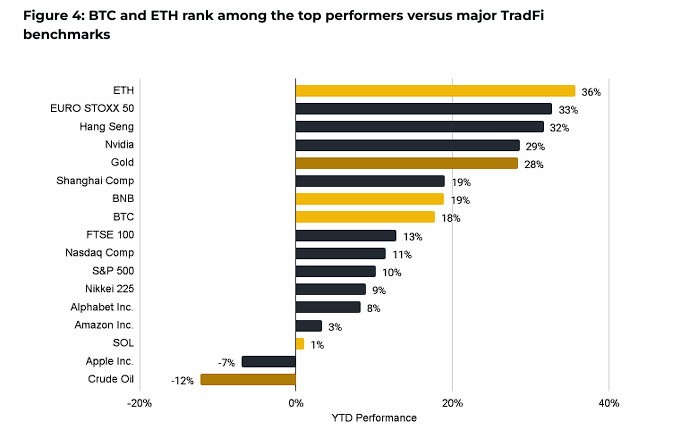

While its recent 28% rally captured headlines, BNB’s year-to-date performance of 19% has also outpaced major assets like Bitcoin (18%), the S&P 500 (10%), and tech stocks like Amazon (3%) and Apple (-7%), underscoring its consistent strength throughout the year.

A New Market Leader Emerges

BNB’s journey through one of crypto’s most turbulent weeks tells a clear story of maturation. The surge to the third spot wasn’t a fluke; it was a clear sign of fundamental strength. When you factor in its resilience during a historic crash, its adoption by a sovereign fund, its deep utility, and its shrinking supply, it all points to one thing: a major shift in how the market values the asset.

By holding key support while other assets fell apart, BNB is challenging an old idea in crypto—that Bitcoin is the only safe place to hide during a storm. BNB has proven its capacity to absorb immense selling pressure and command investor confidence when it matters most. This performance has solidified its position not merely as an exchange token but as a top-tier cryptocurrency with proven strength, poised to remain a formidable and enduring market leader.