In less than a decade, Binance has vaulted from scrappy upstart to the undisputed heavyweight of crypto trading, handling nearly 40% of all global exchange volume. Its ascent has been described as breathtaking, and its survival, perhaps even more so.

Regulators from Washington to Brussels have circled the company, probing its practices and questioning its dominance. Yet Binance has not only endured, but it has emerged with what appears to be a stronger reputation for compliance and institutional credibility.

Behind the scenes, much of that resilience can reportedly be traced to Yi He. The co-founder, long operating outside the spotlight, has been seen as a steady force guiding Binance through crisis after crisis, shaping its strategy and safeguarding its reputation as it expands its global reach.

Yi He: Binance’s Navigator Through Regulatory Turbulence

Born and raised in a rural village in Sichuan, China, Yi He’s life has often been characterized as a true “rags to riches” story, with the co-founder rising from a humble background to billionaire status through determination, modesty, and hard work.

Even after her success in the crypto industry, He is said to have retained “the common touch.” Observers suggest this is also why Binance has maintained a marketing approach that emphasizes accessibility for retail users, a strategy widely credited with driving the company’s rapid growth.

Starting in 2023, circumstances led to He putting her talents to work in a new way. That year, Binance co-founder Changpeng “CZ” Zhao went to prison, following a $4 billion plea deal with the United States government.

This sort of incident can make or break a company, but rather than things going from bad to worse, He reportedly took on the unofficial role of Binance’s chief navigator through this time of regulatory turbulence, implementing sweeping changes that allowed the company to remain operational and continue expanding despite regulatory pressure.

Strategic Transformation Builds a Bridge to Further Expansion

In her efforts to steer Binance through this period, Yi He focused first on overhauling the company’s corporate governance. This included the promotion of Richard Teng, a former financial services regulator in Singapore, to the CEO role. The company also added independent directors to its board.

Binance also made sweeping changes to its KYC and AML practices. Both of these initial moves were said to have made a major impact on the company’s reputation and have been cited as helping attract institutional interest.

Beyond compliance and governance improvements that were seen as steps toward greater regulatory clarity, He’s overhaul included strategic changes that appear to have supported further growth.

One example is Binance’s leveraging of its Dubai hub to expand further into the Middle East and Europe. The company has also emphasized diversity and inclusion, another factor observers believe could be important in crypto’s eventual mainstream adoption.

Continuing to Press Ahead

Binance has seemingly emerged from its troubles as a stronger and more mature organization than before. While now positioning itself as more aligned with institutional compliance benchmarks, the company has not lost the “common touch” that Yi He’s leadership is said to have provided.

The Binance ecosystem—spanning customer-facing products such as Binance Pay and Binance Wallet, and a growing suite of institutional offerings—purportedly benefits from greater regulatory clarity than in previous years. This environment may allow the company to press ahead with its broader ambitions.

Yi He remains a central figure and is reportedly directing efforts toward accelerating crypto’s mainstream adoption, a push that could help Binance reach its long-stated target of 1 billion users. She has placed particular emphasis on the stablecoin market, which she has suggested will be critical to crypto’s integration into the wider financial system. Yi commented, “Crypto isn’t just the future of finance—it’s already reshaping the system, one day at a time.”

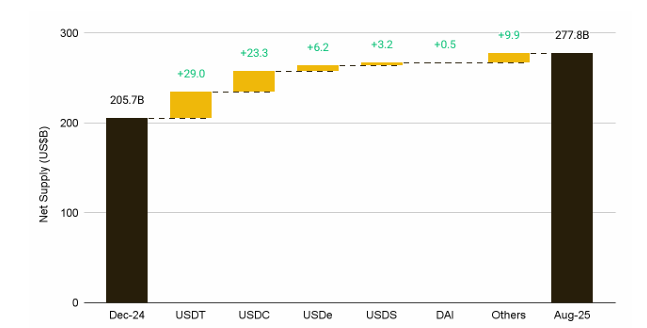

As Binance Research noted in a recently published white paper entitled “10 Charts Shaping 2025,” total stablecoin supply continues to grow steadily, rising 35% to $277.8 billion since the start of the year. Analysts attribute this to a more favorable policy backdrop that has led to massive capital inflows into stablecoins. This could be the prelude to their application in real-world use cases.

New challenges will certainly arise as the blockchain economy further evolves, but much like the myriad of other challenges Yi He has faced, observers expect this co-founder to once again navigate through them.