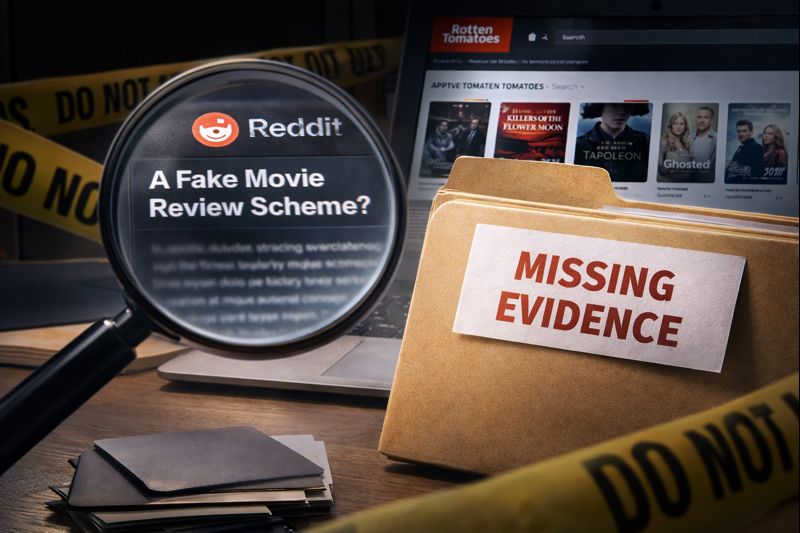

Sophisticated scams surge as filing rule changes create perfect cover for fraud. Your tax anxiety just became a cybersecurity threat. Scammers are weaponizing 2026’s discontinued free filing programs and new tax rules to launch the most sophisticated IRS impersonation campaign ever recorded. With 2.4 million taxpayers already targeted and victims losing $72.8 million according to TIGTA data, this isn’t your typical phishing expedition.

It’s a coordinated assault on confused filers scrambling to understand February’s new landscape.

AI Makes Fake IRS Calls Sound Terrifyingly Real

Voice cloning technology transforms phone scams into perfect impersonations.

These aren’t the robotic scam calls you’re used to hanging up on. AI voice cloning surged 400% in 2025, and fraudsters now create pitch-perfect IRS agent impersonations complete with case numbers and spoofed callback numbers.

“Scammers aim to create a heightened sense of anxiety,” explains Lynette Owens, VP at Trend Micro, noting how criminal networks craft “messages that sound official and helpful.” They’re banking on your filing stress to override your skepticism when that urgent email about “new 2026 compliance requirements” hits your inbox.

The Real IRS Doesn’t Slide Into Your DMs

Government never contacts taxpayers through unsolicited digital channels.

Here’s your reality check: the IRS never initiates contact via email, text, or social media. Period. Real tax communication arrives through postal mail, not Instagram notifications demanding immediate iTunes gift cards to resolve your “account suspension.”

Red flags include:

- Threats of arrest or deportation

- Demands for wire transfers

- Unappealable payment deadlines

That perfectly formatted email with official logos? Pure theater designed to bypass your detection instincts.

Tech Tools Transform Defense Against Tax Fraud

Consumer security software becomes essential armor during filing season.

Smart protection combines healthy skepticism with proper tech defenses. Quality antivirus software blocks malicious tax-prep sites, while password managers prevent credential theft on fake IRS portals. Common computer problems can leave you vulnerable, so before clicking any tax-related link, navigate directly to IRS.gov through your browser—never through email links.

Report suspicious communications to [email protected] and verify any supposed IRS contact by calling their official number directly. Identity theft from tax scams triggers months of credit repair and fraudulent return complications, but verification habits and digital defenses let you file confidently while fraudsters target easier prey.