Owning a Maserati Quattroporte costs $7,090 yearly just to insure—nearly ten times more than a Honda Civic. You probably expected luxury cars to cost more, but here’s what the dealer didn’t mention: your premium isn’t just reflecting the sticker price.

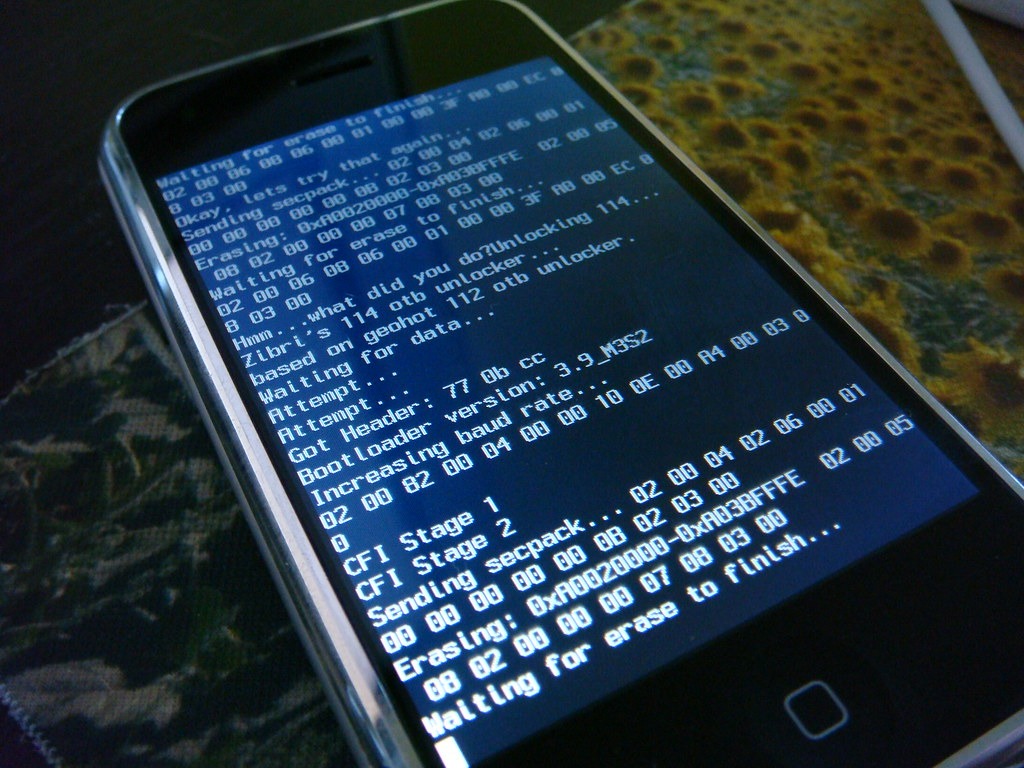

Modern luxury vehicles are essentially smartphones on wheels, packed with sensors, exotic materials, and connected systems that turn every fender-bender into a tech repair nightmare.

Your Carbon Fiber Bumper Costs More Than Most People’s Cars

Exotic materials and embedded sensors make minor accidents devastatingly expensive.

That sleek carbon fiber spoiler isn’t just for show—it’s a repair bill that can reach $15,000 or more, depending on your model. Luxury cars hide ADAS sensors throughout their bodies, embedded in panels that look purely aesthetic.

Bump a parking meter? You’re not just replacing bodywork anymore. You’re recalibrating radar systems, replacing ultrasonic sensors, and potentially reprogramming the entire safety suite. Insurance companies know this, which is why they’re pricing these rolling computers like the delicate electronics they really are.

Thieves Have Algorithms Too

High-performance models face systematic targeting that drives premiums skyward.

The Chevrolet Camaro ZL1 gets stolen at rates more than 20 times higher than average vehicles, according to IIHS data. Thieves aren’t grabbing these cars randomly—they’re hunting specific models for parts or export.

Your track-ready machine becomes a target the moment you park it, and insurers factor this calculated risk into every premium calculation.

Your Car Tattles on Your Lead Foot

Connected vehicle data turns every spirited drive into premium ammunition.

Those same sensors that keep you safe also monitor how you drive. Telematics systems track acceleration patterns, cornering forces, and city driving frequency.

The irony cuts deep: you bought a performance car, but using its capabilities triggers algorithmic penalties. Even wealthy, low-mileage owners face rate hikes when their driving data reveals they actually enjoy their investment.

Fighting Back Against the Algorithm

Strategic moves can tame even the most brutal luxury car premiums.

- Bundle your policies—multi-policy discounts often beat loyalty programs at this tier

- Install advanced anti-theft systems that insurers specifically approve

- Shop aggressively between carriers

Most importantly, shop aggressively between carriers. Luxury car insurance is ruthlessly competitive, and risk models change faster than your vehicle’s over-the-air updates.

Your connected luxury car represents the collision of Silicon Valley innovation with traditional insurance actuarial tables. The result? Premium calculations that reflect both cutting-edge technology and calculated risk, despite your considerable means.