Dead phone batteries are annoying, but your car’s data collection could destroy your life in court. Modern vehicles don’t just transport you—they’re rolling surveillance systems that meticulously document every hard brake, lane change, and moment of distraction. Courts increasingly treat this digital evidence as more reliable than human testimony, and the results can be devastating when lawsuits arise.

Your car knows more about your driving than you remember. Event data recorders capture speed, braking patterns, and seatbelt usage in the seconds before crashes. GPS systems log every destination and route. Driver monitoring cameras track where you look and how often you check your phone. Insurance telematics programs record acceleration patterns, nighttime driving frequency, and cornering forces. According to legal analysts, all of this data is subpoena-friendly and admissible in court proceedings.

Tesla’s legal troubles illustrate how damaging withheld vehicle data can become. In a Miami Autopilot case, expert hackers revealed that Tesla had suppressed crucial driving logs that contradicted the company’s safety claims. The jury awarded $243 million, partly as punishment for data concealment. When manufacturers control the evidence and selectively share information, courts respond harshly to perceived manipulation.

Insurance companies weaponize this data beyond accident scenes. Telematics programs that promise discounts for safe driving often become evidence against policyholders during claims. Hard braking events, rapid acceleration, or late-night trips can justify denied claims or premium increases. Insurers may retain and analyze your historical driving data even after you opt out of their monitoring programs, though specific practices vary by provider and state law.

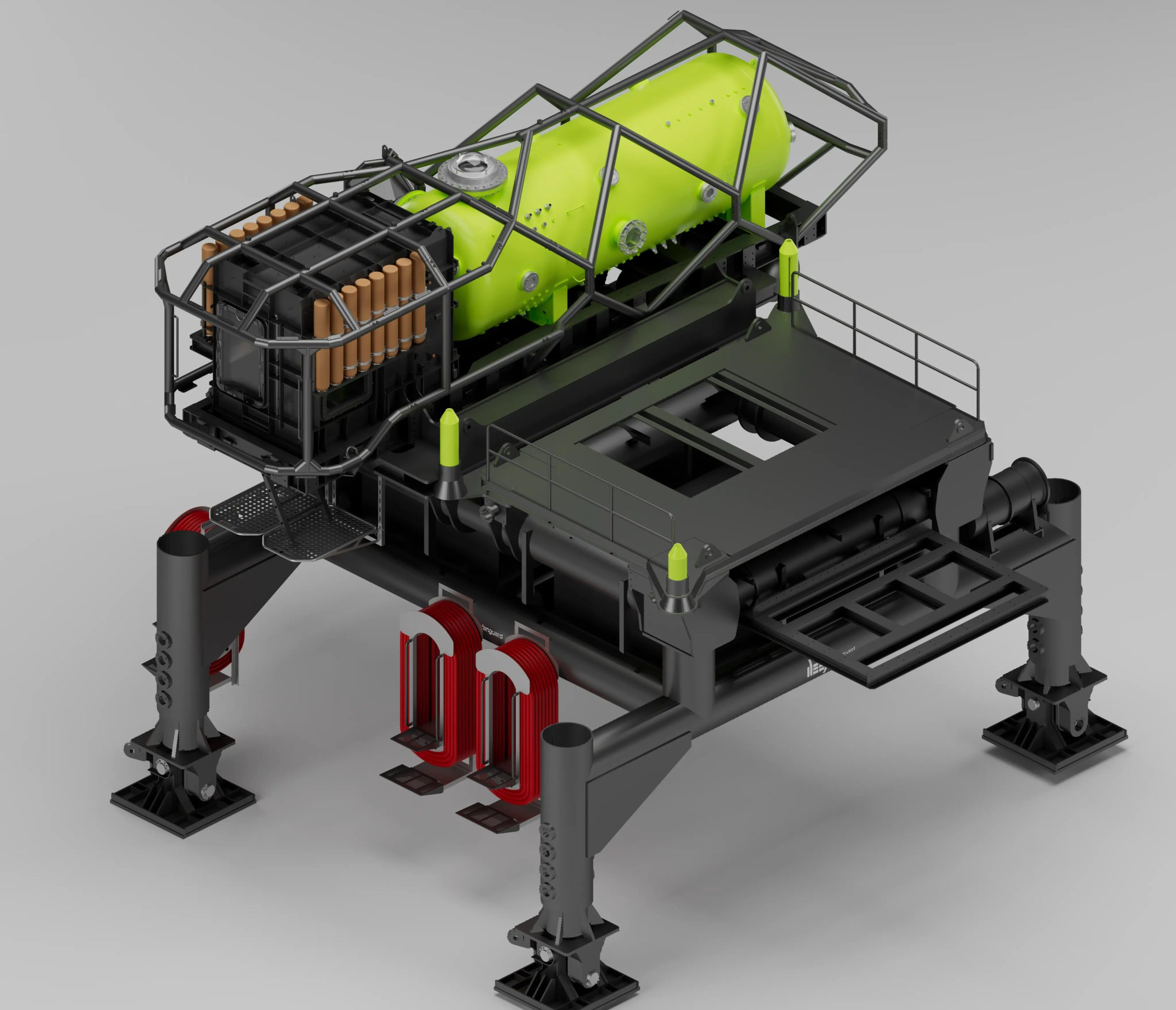

The liability landscape is shifting as automotive technology advances. When driver-assistance systems fail or mislead users about their capabilities, manufacturers face product liability claims worth hundreds of millions. Your car’s detailed logs become crucial evidence in determining whether human error or technological failure caused an accident.

This digital surveillance happens with minimal transparency or control. Unlike your smartphone’s privacy settings, automotive data collection operates largely without your explicit consent. As AI-powered accident reconstruction becomes increasingly common in courtrooms, your vehicle’s version of events may carry more weight than your own testimony. Every drive generates potential evidence that could support or sink your case in litigation you never saw coming.

The smartest approach? Understand what your specific vehicle collects and consider these digital footprints when making car-buying decisions. Your next vehicle purchase isn’t just about horsepower and fuel economy—it’s about how much evidence you’re comfortable creating against yourself.