The unseen builders of tomorrow are not necessarily what you’d expect. Behind the most advanced technologies lie materials that laypeople may never have heard of. Without them, microchips would not exist, 5G networks would not have emerged, and self‑driving vehicles would still be a distant dream.

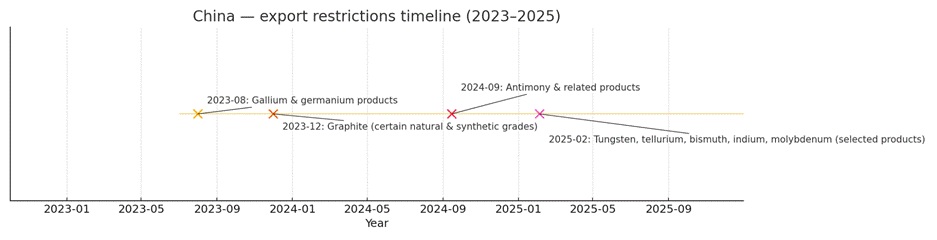

These materials are pivotal in all aspects of groundbreaking technology and form the foundation of the most advanced offensive and defensive weapons in the world. This unique position places them in a highly strategic position, and as such, they are increasingly subject to export controls and restrictions.

These materials are often scarce. Their rarity sometimes stems from their low natural abundance in the Earth’s crust. In other cases, it reflects the specialized know‑how required to extract them as by‑products during the processing of other materials. Sometimes they are difficult to access because they are concentrated in specific geographic regions. Often, they are mined, produced, and controlled by China, THE principal strategic competitor to the West.

Top 10 Technology Materials in 2025

- Gallium (Ga)

- Used In: GaN/GaAs chips for fast power electronics, 5G/RF, LEDs, and laser diodes.

- Why: Wide‑bandgap semiconductors give high efficiency, high frequency, and small size.

- Who buys (examples): RF & power chip makers (Infineon, Qorvo), LED makers (Nichia, ams OSRAM), foundries (TSMC).

- Germanium (Ge)

- Used In: Doping in fiber‑optic glass, infrared optics, and Ge substrates for high‑efficiency space solar cells.

- Why: Boosts fiber performance, transmits IR, and enables multi‑junction solar.

- Who buys (examples): Fiber makers (Corning), IR camera/optics firms (Teledyne FLIR), space‑solar suppliers (Rocket Lab’s SolAero).

- Indium (In)

- Used In: Indium‑tin‑oxide (ITO) transparent electrodes in displays and touchscreens.

- Why: Conducts electricity while staying optically clear.

- Who buys (examples): Display panel makers (Samsung Display, LG Display, BOE).

- Neodymium (Nd)

- Used In: NdFeB permanent magnets for EV motors, wind‑turbine generators, and precision actuators.

- Why: Highest strength‑to‑weight magnets → compact, efficient machines.

- Who buys (examples): EV OEMs (Tesla, Toyota), wind OEMs (Siemens Gamesa, Vestas), motor suppliers (Nidec).

- Palladium (Pd)

- Used In: Automotive catalytic converters and industrial hydrogenation catalysts; also electronics plating.

- Why: Enables exhaust aftertreatment to meet emissions with tiny loadings.

- Who buys (examples): Auto‑catalyst makers (Johnson Matthey, BASF, Umicore); automakers via those suppliers (Toyota, Volkswagen).

- Tantalum (Ta)

- Used In: High‑reliability, high‑capacitance tantalum capacitors in phones, networking, medical, and automotive electronics.

- Why: Stable capacitance in very small packages.

- Who buys (examples): Capacitor makers (KYOCERA AVX, KEMET/Yageo, Vishay); electronics OEMs (Apple, Cisco).

- Hafnium (Hf)

- Used In: Hafnium‑oxide “high‑k” gate dielectrics in advanced CMOS and some memory nodes.

- Why: Cuts leakage and enables continued transistor scaling.

- Who buys (examples): Leading chip fabs (Intel, TSMC, Samsung).

- Tellurium (Te)

- Used In: Cadmium‑telluride (CdTe) thin‑film solar modules.

- Why: Extremely strong light absorption with microns‑thin layers → low‑cost utility solar.

- Who buys (examples): CdTe solar manufacturers (First Solar).

- Rhenium (Re)

- Used In: Added in small % to nickel superalloys for jet‑engine turbine blades and industrial gas turbines.

- Why: Dramatically improves high‑temperature strength and creep resistance.

- Who buys (examples): Jet‑engine makers (GE Aerospace, Pratt & Whitney, Rolls‑Royce).

- Niobium (Nb)

- Used In: Micro‑alloy (<0.1%) in HSLA steels for pipelines, autos, and structural steel.

- Why: Big strength/toughness boost from a tiny addition.

- Who buys (examples): Steelmakers (ArcelorMittal, Nippon Steel, Baowu); pipe producers (Tenaris).

Gallium and germanium sit at the intersection of this dependence. They are foundational to Silicon Valley’s semiconductor ecosystem.

While silicon often falls short in certain high‑stakes electronics, gallium arsenide (GaAs) and related III‑V compounds excel. They are the leading materials for the radio‑frequency front ends of 5G phones, satellite links, and advanced radar modules because they enable faster electron mobility and more efficient heat management.

Germanium’s distinct value is in optics: paired with silicon in photonics or used in high‑purity fiber systems, it helps transmit and detect light with minimal loss, making data transfer more seamless. Together, these materials also enable new device architectures that power components in advanced chargers that deliver stronger performance with less energy consumption, a key concept in microchips.

And they are both irreplaceable.

China’s 80% Problem

Production is concentrated to a degree that should give U.S. policymakers pause. China dominates the market, accounting for roughly four‑fifths of refined gallium and the great majority of refined germanium. Gallium is a by‑product of aluminum processing, while germanium is a minor by‑product of zinc refining.

This means producers cannot readily increase output to meet demand without overhauling upstream mining and processing.

When export restrictions tighten abruptly, the impact is immediate, disrupting semiconductor wafer fabs, immobilizing device makers, and ultimately affecting consumers. These markets are opaque and thinly traded, leaving prices vulnerable to sudden, explosive spikes, unlike the deeper, more liquid markets for copper or oil.

Concentration risk doesn’t just raise rare metal prices; it reshapes product roadmaps.

The Investment Wild West

For investors and procurement teams alike, strategic metals feel less like classic commodities and more like timing puzzles. “Investing in rare strategic metals like gallium and germanium is less about speculation and more about anticipating future tech bottlenecks,” notes Russell Gous of EarthRarest.com.

Capturing how thin liquidity and lumpy demand can produce outsized returns. A single foundry qualification, a defense contract, or a national stockpile purchase can yank supply off the open market and double spot prices before spreadsheets catch up.

There’s also no universal benchmark index to hedge against, leaving manufacturers exposed unless they negotiate long-term offtake agreements or keep buffer inventory. Resilience is the better course of action for them, while investors can utilise the unique market dynamics to profit.